Insurance For Car In Clovis Otosigna – A Complete In 2023!

As a younger girl, I used to worry about why car insurance in Clovis Otosigna 2023 played an important role.

Stick with me as I delve into the various aspects of car insurance to help you make informed decisions and navigate the world of auto coverage with confidence.

Car insurance in Clovis Otosigna in 2023 offers a world of possibilities, from understanding different coverage types to navigating the future of auto insurance. It’s all about making informed decisions and ensuring your vehicle is protected on the road.

Table of Contents:

What Is Car Insurance In Clovis Otosigna? – A Quick Check!

First, let’s begin with the fundamentals before we get into the specifics. Car insurance in Clovis Otosigna is your shield against the unexpected.

It provides financial protection when life takes an unexpected turn on the road. With the right coverage, you can hit the streets with peace of mind, knowing that you’re safeguarded.

Different Types Of Insurance For Cars in Clovis Otosigna – Let’s Explore Them Perfectly!

1. Firstly Check Out The Liability Coverage:

Primarily, The most fundamental motor insurance is liability coverage, mandated by law in Clovis Otosigna. It comprises two components one for property damage liability and the other for bodily injury liability.

Property damage liability covers the costs of repairing or replacing damaged property, while bodily injury liability covers medical expenses and lost income for the injured party.

Read Also: Allstate Insurance Español – Explore The Facts In 2023!

2. Next, Collision Coverage:

Another Factor Is Collision coverage provides financial security for your vehicle in the event of an accident, irrespective of fault, making it a crucial asset for newer or higher-end automobiles, as repairs can often incur significant expenses.

3. Now, Comprehensive Coverage:

Furthermore, Your car is covered by comprehensive coverage in case of theft, vandalism, or natural disaster damages that aren’t caused by crashes. It offers a broader range of protection and ensures security against a wide array of potential dangers.

4. Go For The Personal Injury Protection:

Moving On, Personal injury insurance, or PIP, pays for your and your passengers’ accident-related medical bills, lost earnings, and other expenditures. Regardless of who is at blame, it is supposed to offer a higher degree of coverage for injuries suffered in an accident.

Read Also: Surgical Notes Hiring Insurance Verification Specialist – Apply Now!

5. Moreover, Coverage for Uninsured or Underinsured Drivers:

Lastly, If you are involved in an accident with an uninsured driver or have insufficient insurance to adequately cover your damages, you are protected by uninsured/underinsured motorist coverage.

Also, This insurance ensures you are compensated financially even if the other party cannot pay the bills.

There You Have It! It’s essential to check these types to secure your car insurance policy in Clovis Otosigna. Don’t miss these crucial steps to ensure your peace of mind on the road.

Read Also: Approved By One’s Insurance Company Say Crossword – The Ultimate Guide!

What Factors Affect Car Insurance Rates? – CheckThe Four One!

Must Matter The Age and Driving Experience:

Due to their lack of driving expertise, younger and inexperienced drivers are generally perceived to be at a more significant hazard. Consequently, individuals in this category frequently face elevated insurance costs, while more experienced and mature drivers may qualify for reduced premiums.

Make Sure Vehicle Type, Make, and Model Is reliable:

Also, Insurance premiums are primarily determined by the kind of car you drive. The make, model, age, and safety features of your vehicle are among the elements that insurance providers consider. Lower rates are often associated with cars rated safer and less likely to be involved in accidents or theft.

Read Also: Karz Insurance – A Complete Guidebook In Detail!

Check Out The Driving Record and Claims History:

Even Your driving and claim history significantly impact your vehicle insurance premiums. A driving record without accidents or moving violations demonstrates responsible driving, potentially leading to reduced insurance premiums.

Conversely, insurance premiums may rise when there is a track record of accidents or past involvement in traffic offenses.

Additionally, Your Residence and Parking Spot:

For That Reason, Your insurance premiums may vary depending on where you live and park your car. If you live in a neighborhood with elevated accident or crime rates, insurance companies might consider you a greater risk and, consequently, increase your insurance premiums.

Moving On, Insurance and Credit Scores:

After All, When calculating premiums, insurers usually evaluate your insurance and credit scores. Research indicates that individuals with lower insurance or credit scores tend to be more inclined to submit insurance claims, potentially leading to increased insurance premiums for these policyholders.

Read Also: Business Insurance Levantam – Get The Right Business Insurance!

How To Choose The Right Car Insurance Policy – Check The Perfect Thoughts!

First and foremost, it’s crucial to analyze your insurance requirements. Take into consideration your financial situation and the level of coverage you feel comfortable with. This means thinking about your budget, the value of your car, and any potential risks you might face on the road.

Next, it’s essential to understand deductibles and policy limits. The policy limit is the maximum amount your insurance provider will pay out in the event of a claim, while deductibles are the amount you must pay out of pocket before your insurance coverage kicks in.

Additionally, it’s worth evaluating additional coverage options. You might want to consider supplemental insurance choices like gap coverage, roadside assistance, or rental car reimbursement, depending on your individual circumstances.

Furthermore, it’s wise to consider customer reviews and the reputation of insurers. Check for consumer reviews and ratings to gauge the trustworthiness and quality of customer service provided by insurance companies.

Read Also: Brad Linnell – State Farm Insurance Agent Medford Reviews

How To Apply For Car Insurance In Clovis Otosigna – Important Insights!

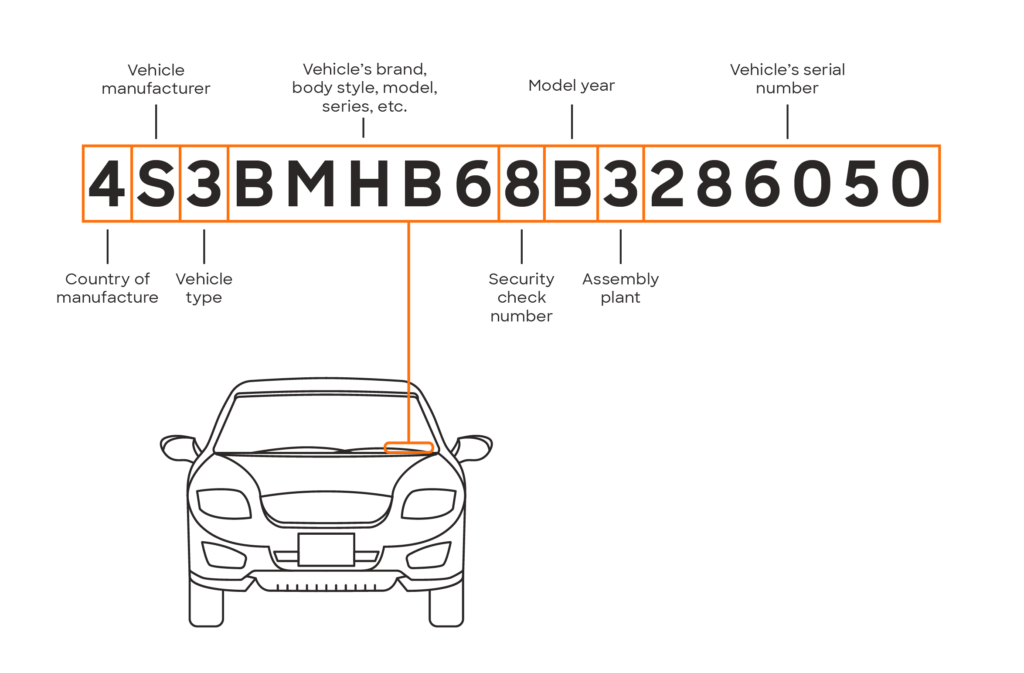

- Gather Required Information: Before you start, make sure you have all the necessary information handy. This typically includes your driver’s license, vehicle registration, and Social Security number.

- Contact Insurance Providers: Reach out to insurance providers in Clovis Otosigna. You can do this by visiting their websites, calling their offices, or even visiting them in person.

- Request Quotes: Ask for car insurance quotes from the providers you contact. They will need specific details about your vehicle and driving history to provide accurate quotes.

- Compare Quotes: Once you have quotes from multiple providers, take the time to compare them. Consider the coverage offered, premiums, and any additional benefits or discounts.

- Choose Your Policy: Select the car insurance policy that best suits your needs and budget. You may want to discuss the options with an agent to ensure you’re making an informed decision.

- Submit Your Application: After deciding on a policy, you can typically complete the application process online or in person at the insurance provider’s office.

- Pay Your Premium: Once your application is approved, you’ll need to make your initial premium payment. Many insurers offer various payment options, including monthly or annual payments.

And that’s it! You’ll be on your way to enjoying the peace of mind that comes with having car insurance in Clovis Otosigna.

Read Also: Commonly Asked Questions About Scalp Tattoos In 2023

Car Insurance Discounts And Savings Opportunities!

Certainly, getting discounts on your car insurance is a great way to save money. You can qualify for these discounts by being a safe driver with a clean record or by doing well in school if you’re a student.

Also, if you have other types of insurance, like home or renters insurance, you can bundle them with your car insurance to lower your overall costs. Some insurance companies even track your driving habits, and if you drive safely, they’ll offer you discounts.

And if you’ve been with the same insurance company for a while, they might give you loyalty rewards and lower rates when you renew your policy. So, there are several ways to make your car insurance more affordable.

Read Also: What Is Husky B Insurance In CT? – Detailed Guide In 2023!

How To Prevent Car Insurance Fraud And Scams – Check This Out!

Identifying Common Insurance Fraud:

Familiarize yourself with prevalent insurance scams, such as staged accidents, fraudulent injury claims, and inflated repair costs. Exercise caution when encountering individuals or organizations promising remarkably low premiums or pressuring you to provide false information.

Guidance for Preventing Insurance Fraud:

Opt for reputable insurance companies and agents to safeguard against fraudulent activities. When sharing personal information, exercise prudence and gain a thorough understanding of the terms and conditions of any insurance policy you are considering.

Read Also: Understanding the Role of Rehab Centers in Substance Abuse Recovery

Reporting and Addressing Fraudulent Activities:

Promptly notify the relevant authorities or your insurance provider if you suspect or come across any fraudulent behaviour in the realm of auto insurance. Reporting suspicious activities promptly will help prevent further fraud and protect both yourself and others from harm.

Frequently Asked Questions:

1. What Does Otosigna Car Insurance Offer in Clovis?

Otosigna Car Insurance in Clovis is a reputable insurance provider specializing in coverage for vehicles within the Clovis region. They offer a variety of insurance packages designed to cater to the needs of Clovis residents.

2. How to Obtain a Car Insurance Quote from Otosigna in Clovis?

To receive a car insurance quote from Otosigna in Clovis, simply visit their website, input your details, and receive a personalized quote in just minutes. Alternatively, you can get in touch with their local Clovis office for assistance.

3. Can I Personalize My Car Insurance Policy with Otosigna in Clovis?

Certainly, Otosigna allows you to tailor your car insurance policy in Clovis to match your specific requirements. You can include optional coverages and adjust coverage limits to create a policy that’s tailored to you.

4. Is it Possible to Make Online Payments for My Otosigna Car Insurance Premiums in Clovis?

Yes, Otosigna offers the convenience of online payment options for car insurance premiums in Clovis. You can log in to their website, set up automatic payments, or make one-time payments with ease.

Heading Towards The End:

In Essence, Car insurance in Clovis Otosigna in 2023 opens up a realm of opportunities and choices. Whether you’re a novice driver aiming to secure suitable coverage or an experienced motorist searching for cost-effective solutions, there are multiple avenues to explore.

Prepare yourself for an exhilarating journey and make well-informed decisions to safeguard your vehicle in Clovis Otosigna in 2023!”